Key Takeaways

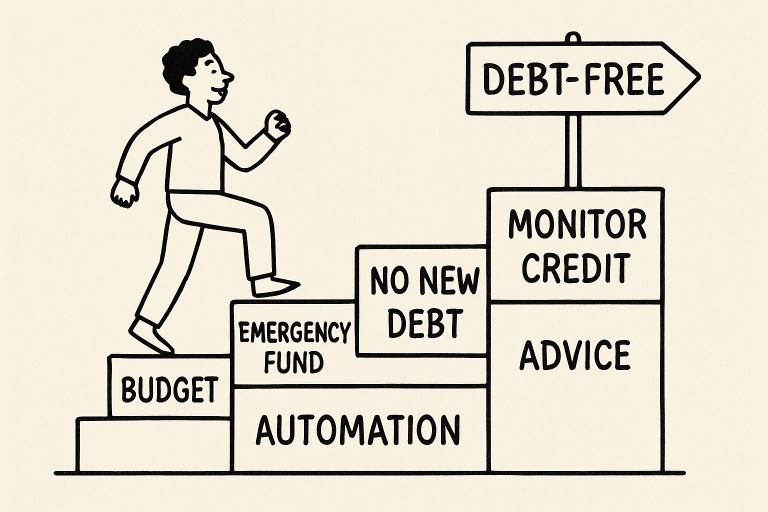

- Staying debt-free after consolidation requires ongoing commitment and strong financial habits.

- Establishing a budget and an emergency fund are foundational steps toward lasting financial health.

- Automation, credit monitoring, and professional advice can safeguard your progress.

Table of Contents

- Create a Realistic Budget

- Build an Emergency Fund

- Avoid Accumulating New Debt

- Automate Payments

- Monitor Your Credit Report

- Seek Professional Advice

Consolidating your debt can be a life-changing move, providing relief from high interest rates and simplifying your monthly payments. However, without mindful management, old spending patterns can resurface, creating a cycle of debt that is difficult to break—integrating smart habits after consolidation is crucial for achieving long-term success. One effective way to stay motivated and learn new financial strategies is by connecting with communities and resources such as Symple Lending. Establishing lasting financial stability goes beyond just debt consolidation; it involves a deep understanding of your spending habits, tracking your expenses, and actively working towards personal financial goals. Adopting practical strategies and holding yourself accountable can help you avoid the pitfalls of post-consolidation debt.

When evaluating your progress, remember that staying debt-free doesn’t mean restricting yourself excessively—but rather learning how to make smarter choices and preparing for life’s uncertainties. As you refine your financial skills, reaching out to proven sources for guidance can be particularly useful.

Throughout your journey, remember that support and inspiration can be found in experienced professionals in the field who share valuable insights and updates on debt-free living and smart lending practices.

Create a Realistic Budget

Budgeting is your blueprint for financial health, according to Houston Fraley, CEO. Start by listing all sources of income, including your salary, bonuses, and any side gigs. Next, document fixed expenses (such as rent, car payments, and utilities) and variable expenses (including groceries, entertainment, and dining out). An honest assessment of your current lifestyle will reveal spending patterns that can be adjusted to achieve better savings.

Utilize digital tools or budgeting apps to track your expenses and stay on track with your plan. Regularly reviewing your budget helps you stay on top of changes in income or expenses. If you face challenges keeping your spending in check, consider using the envelope method or a zero-based budget, where every dollar is assigned a specific task.

Tips for Effective Budgeting

- Set achievable spending limits in every category.

- Allow some wiggle room for unexpected expenses.

- Update your budget monthly to reflect real changes in your financial life.

Build an Emergency Fund

Life is unpredictable, and having an emergency fund prepares you for financial surprises such as car repairs, medical bills, or sudden job loss. Most experts recommend saving enough to cover three to six months’ worth of essential expenses. Start small by setting aside a portion of each paycheck into a dedicated savings account.

Automated savings transfers help ensure consistency. Even a modest fund can prevent you from relying on credit cards during a crisis, protecting your hard-earned progress. According to CNBC, automating your savings is one of the most effective methods to build a robust safety net gradually.

Avoid Accumulating New Debt

After consolidating, it’s tempting to use your newly available credit—but this can quickly undermine your financial progress. Only use credit cards for essential purchases or emergencies, and pay off the full balance each month to avoid interest charges. Adopting a cash or debit-only policy for everyday expenses reduces the likelihood of overspending.

If you feel drawn to shop during sales or as a stress relief, pause and reconsider the long-term consequences. Taking small steps such as maintaining a shopping list, planning purchases in advance, and removing saved cards from online accounts can help reduce impulsive spending.

Automate Payments

Missing payments can quickly lead to fees, added interest, and a lower credit score. Setting up automatic payments for your consolidated loan and other monthly bills ensures on-time payments and helps maintain your positive momentum. Many lenders and service providers offer autopay options that can make your financial life less stressful.

Automation not only saves you time but also helps you avoid the risk of human error. While automation is helpful, continue to check your account balances monthly to ensure payments are being made as scheduled, especially after a change in banks, jobs, or loan servicers.

Monitor Your Credit Report

Regular credit monitoring enables you to check your financial health, track your progress, and identify any inaccurate or suspicious activity. The three major credit bureaus—Equifax, Experian, and TransUnion—offer free annual credit reports, and some financial institutions provide free monthly credit scores. Reviewing your credit report not only gives you peace of mind but also empowers you to dispute errors and ensure your hard work is reflected.

According to Consumer Reports, staying vigilant about your credit report can help you catch issues early and protect your score while reinforcing your debt-free journey.

Seek Professional Advice

If you find yourself struggling to maintain a structured approach or achieve financial stability, reaching out to a certified financial advisor can be an excellent step. Professional guidance is especially valuable when setting long-term goals, reviewing investment options, or navigating complex financial situations. Personalized advice can help you secure a stable, debt-free future.

Many non-profit organizations also offer free or low-cost financial counseling for individuals managing new budgets or recovering from debt.

Conclusion

Staying debt-free after debt consolidation is entirely achievable with the right strategies and continual self-awareness. By budgeting thoughtfully, planning for emergencies, avoiding new debt, automating payments, monitoring your credit, and seeking support when needed, you protect your progress and lay a solid foundation for lasting financial health. Start with small, consistent actions and remember that real change occurs over time. Your commitment today ensures your financial freedom tomorrow.